BEST STOCK MARKET CLASSES

STOCKS STRIDE

STOKS STRIDE

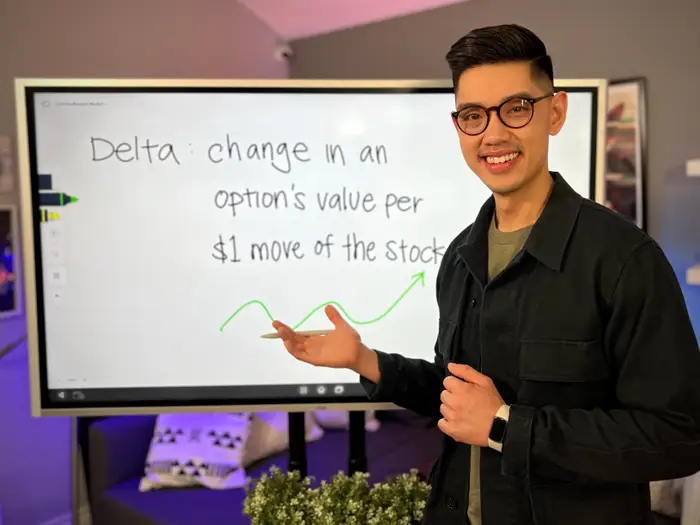

Enrolling in Share market classes in Indore can provide you with a lot of opportunities to enter the world of investing. It can be a game-changer as you can learn the tricks of the trade and create an attractive portfolio.

By enrolling in share market classes in Indore, you’ll gain a solid understanding of stock market concepts. Learn to analyze companies with fundamental analysis and predict price trends using technical indicators.

About Us

At STOCK STRIDE , we are passionate about empowering individuals with the knowledge and confidence to navigate the stock market successfully. Our mission is to demystify the world of trading and investing through structured, easy-to-understand stock market classes tailored for beginners, intermediate learners, and aspiring professionals. Our team of seasoned traders and financial educators bring real-world insights to every session. Whether you’re looking to build long-term wealth, trade actively, or simply understand how markets work, our programs are designed to equip you with practical skills, risk management techniques, and strategic thinking.

LIVE SESSION

Live market session for students to overcome FOMO Trading, OVER Trading, REVENGE Trading and EMOTIONAL Trading and make you a proper Neutral Trader.

TRAINING

We are providing online and offline classes, so that you can learn from anywhere and earn from your comfort zone.

OUR VALUE

Community Support: Collaborative growth and shared experiences.

OUR VISION

Empower every individual and organization globally to enhance earnings. Recognize the emerging trend in trading and investing. Focus on equipping individuals with skills for this trend. Our Vision is to offer offline and online courses led by experts. Aim to prepare individuals for success in trading and investing.

OUR MISSION

Mission: Ensure students develop personalized trading plans. Goals: Attain optimal stock selection, precise entry and exit timing. Focus on effective risk and money management. Aim for growth in students’ trading and investing accounts.

Ready to Transform Your Portfolio? In 16 Weeks with.

Why Choose Stock Stride!

Integrity and Trust :- Our institute operates with the highest standards of integrity, transparency, and professionalism. We believe that trust is the foundation of effective learning, and we are committed to building a supportive environment for every student.

Industry Expertise :- Led by Lakshya Jain a seasoned market expert with over eight years of experience, our courses are designed to keep you updated with industry trends, regulations, and best practices. With expert guidance, you gain the insights necessary to navigate the complexities of the stock market.

Comprehensive Skill Development :- Our curriculum covers essential skills such as technical analysis, risk management, and trading psychology. Our hands-on training provides the practical experience necessary to build confidence and competence in the market.

Trusted Certifications :- Stock Stride offers industry-recognized certifications that help distinguish you as a qualified professional. Our certifications reflect our dedication to quality education and help enhance your credibility in the finance industry.

Before Joining

After Joining

Learn more about Stock Trading

Dive into the world of investing with a stock trading course from Udemy. Real-world experts will help you understand the basics of buying and selling, along with the different types of modern trading including day trading, swing trading, and position trading. Decode Wall Street and make extra income — or invest in yourself and make a career change. Traders aim to profit from short-term price movements, unlike investors who typically hold stocks long-term. There are several trading styles, including day trading, swing trading, and position trading, each with different time horizons and strategies. While stock trading offers the potential for high returns, it also involves risks. Prices can be highly volatile, and losses are possible without proper risk management. Successful traders often rely on discipline, strategy, and continuous learning.

Ready to explore the markets? Start small, stay informed, and grow your trading skills step by step.

Skills demand 250,000 +

Courses taught by real-world experts

Lifetime access

Frequently asked questions

The stock market refers to public markets that exist for issuing, buying, and selling stocks that trade on stock exchanges. Stocks represent fractional ownership in a company. The stock market is where traders buy and sell stocks. The stock market serves two important purposes. For companies, it provides a means to acquire capital as a way to fund and expand their business. For stock traders, it provides an opportunity to share in the profits of publicly traded companies. In the U.S., there are multiple regional stock exchanges, while most other countries maintain a single stock exchange. Stock trading is the activity of buying and selling shares of publicly traded companies with the goal of securing a profit or loss.

There are several different stock trading strategies. Day trading refers to buying and selling stocks in one day. Traders sell stocks the same day, so they never hold a position overnight. Position trading involves buying and holding stock based on anticipated trends. The goal is to identify the market direction based on prediction charts and monitor the trend to capture the apex gain/loss. At the end of a trend, the stock price fluctuates while it establishes a new price. Swing Trading takes advantage of this price volatility period and uses fundamental analysis to determine when to buy and sell. Scalping is one of the quickest trading strategies for spread advantage. The trader buys at the bid price and sells at the asking price to profit off the differential. Fading is short selling a stock when the trader believes it has been overbought. A sell trade is executed when the price passes the target trend apex. When the trend reverses and there is a price correction, the trader purchases the lower-priced stock.

Anyone looking for a way to make extra income can learn to trade stocks. Becoming a successful trader doesn’t require an MBA or many years on the floor of a stock exchange. Some traders are self-taught and read books, articles, and websites; others take a few courses to get a good handle on how to become a successful trader. Before making your first trade, it’s important to understand how the markets work, the different types of securities you can trade, the purpose of a broker, and how to read market data. For those without prior experience, learning how to analyze the markets is also very important. You will also need to take some time to practice and observe how to execute a trade successfully. Udemy courses can teach you the basics, from opening a brokerage account and buying and selling stocks on different exchanges to more advanced, specific skills like candlestick trading and portfolio optimization.

All traders need to develop a strong understanding of how to interpret stock trends and measure the health of a business. Fundamental analysis helps traders capture the “big picture” of a particular company’s potential for profit and future growth; this type of stock analysis focuses on the long-term success of a company rather than making quick decisions based on short-term data. It requires traders to look at qualitative data and get a good understanding of a company’s health beyond its basic financial numbers. Fundamental analysis helps traders see the overall state of the economy and focus on factors like interest rates, employment rate, GDP, international trade, and manufacturing. As you develop your knowledge of the stock markets and what it takes to execute a successful trade, you’ll find that fundamental analysis skills will provide you with the essential knowledge to confidently make a successful trade.